|

Annuities

Many of the most common financial arrangements are structured as annuities, including mortgage and rent payments, insurance premiums, retirement benefits -- even a salaried worker's pay. An annuity will be either an ordinary annuity or an annuity due. The difference lies in the timing of each payment relative to the period the payment covers.

In finance, an annuity is any series of equal payments that are made at regular intervals. Though the word "annuity" comes from the Latin for "yearly," the periods between payments in an annuity can be just about anything -- years, months, weeks; it doesn't matter as long as the interval is consistent. An annuity can also last for a short period -- say a few months -- or for decades.

Ordinary Annuity

With an ordinary annuity, the payment comes at the end of the covered term. The typical home mortgage is an example of an ordinary annuity. When you pay your mortgage on Sept. 1, for example, you're actually paying for the use of your home (and the use of the lender's money) for August. You'll pay for September on Oct. 1, and so on. Most annuities are ordinary annuities, which is why they're called "ordinary." Other common examples include interest payments from bonds and payments on installment loans.

Annuity Due

In an annuity due, the payment comes at the beginning of the term. The most familiar application of the annuity due is rent. When you pay apartment rent on Sept. 1, you're paying for the use of the apartment in September. Unlike with a mortgage, when your first payment typically isn't due until after your first full month in the home, your first rent payment is due when you move in. Insurance premiums are another common example of an annuity due; you pay today for coverage in the future.

Comparison / Distinction between an Ordinary Annuity and an Annuity-Due

In general, if you're the one making the payments, you're better off with an ordinary annuity. If you're the one receiving the payments, you're better off with an annuity due. The reason lies in a basic principle of finance known as the "time value of money": Because of inflation and the ability to earn interest on invested or banked money, a sum of money today is worth more than the same sum in the future. The longer you can delay making your first fixed payment, the less that payment costs you.

On the flip side, the earlier you can receive the first payment of an annuity, the more it's worth. Practically speaking, though, once an annuity begins, the cash flows occur on the same schedule, and there's little noticeable difference between an ordinary annuity and an annuity due. Each payment of an ordinary annuity belongs to the payment period preceding its date, while the payment of an annuity-due refers to a payment periodfollowing its date.

The meaning of the above statement may not be immediately obvious until we look at it graphically...

A more simplistic way of expressing the distinction is to say that payments made under an ordinary annuity occur at the end of the period while payments made under an annuity due occur at the beginning of the period.

A third possibility is to define an annuity due in terms of an ordinary annuity: an annuity-due is an ordinary annuity that has its term beginning and ending one period earlier than an ordinary annuity. This definition is useful because this is how we will compute an annuity due; i.e., in relation to an ordinary annuity (discussed further in "Calculating the Value of an Annuity Due" below).

Most annuities are ordinary annuities. Installment loans and coupon bearing bonds are examples of ordinary annuities. Rent payments, which are typically due on the day commencing with the rental period, are an example of an annuity-due.

2. Calculating the Value of an Annuity Due

An annuity due is calculated in reference to an ordinary annuity. In other words, to calculate either the present value (PV) or future value (FV) of an annuity-due, we simply calculate the value of the comparable ordinary annuity and multiply the result by a factor of (1 + i) as shown below...

AnnuityDue = AnnuityOrdinary x (1 + i)

This makes sense because if we go back to our earlier definitions we see that the difference between the ordinary annuity and the annuity due is one compounding period.

Note also that the above formula implies that both the PV and the FV of an annuity due will be greater than their comparable ordinary annuity values. This is illustrated graphically in the section that follows, "Visual Comparison of Cash Flows." It can also be clearly seen in the discount and accumulation schedules constructed in the "Excel" section.

The following examples illustrate the mechanics of the ordinary annuity calculation and subsequent annuity due calculation.

a. Present Value of an Annuity

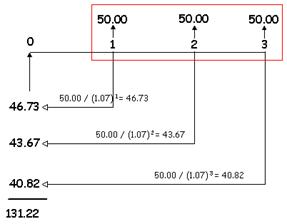

Using the example problem from the Present Value of an Annuity, we calculate the PV of an ordinary annuity of 50 per year over 3 years at 7% as...

...and the present value of an annuity due under the same terms is calculated as...

...and just as we thought, the PV of the annuity due is greater than the PV of the ordinary annuity; by 9.18 in this example.

b. Future Value of an Annuity

Using the example problem from the Future Value of an Annuity, we calclate the FV of an ordinary annuity of 25 per year over 3 years at 9% as...

...and the future value of an annuity due under the same terms is calculated as...

...and again the FV of the annuity due is greater than the FV of the ordinary annuity; in this example by 7.38.

3. Visual Comparison of Cash Flows

The distinction between an ordinary annuity and an annuity-due can be easily grasped by visualizing the timing of the payments.

a. Present Value of an Annuity:

Ordinary Annuity. Continuing with the same example from the Present Value of an Annuity, the following illustration shows how payments are applied in the case of an ordinary annuity:

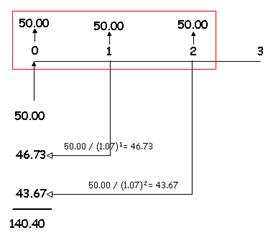

Annuity-Due. With an annuity-due the payments are made at the beginning rather than the end of the period...

Note that the PV of the ordinary annuity is 131.22 and the PV of the annuity-due is 140.40 (calculated as 131.22 x 1.07).

The fact that the value of the annuity-due is greater makes sense because all the payments are being shifted back (closer to the start) by one period. This means the PV should be larger under the annuity due because all the payments are made earlier. In other words, they are all closer to the "present" so they are subject to less discounting. Note that there is no need to discount the first payment under the annuity due at all; since it is made at the very outset, its PVis its face value.

b. Future Value of an Annuity:

Continuing with the same example from the Future Value of an Annuity, the following illustration shows how payments are applied in the case of an ordinary annuity...

Annuity-Due. With an annuity-due the payments are made at the beginning rather than the end of the period.

Note that the FV of the ordinary annuity is 81.95 and the FV of the annuity-due is 89.33 (calculated as 81.95 x 1.09).

The fact that the value of the annuity-due is greater makes sense because all the payments are being shifted back (closer to the start) by one period. Moving the payments back means there is an additional period available for compounding. Note the under the annuity due the first payment compounds for 3 periods while under the ordinary annuity it compounds for only 2 periods. Likewise for the second and third payments; they all have an additional compounding period under the annuity due. The additional compounding generates a larger FV.

Present Value and Future Value of an Annuity - Example

- For calculating PV of Annuity, PV of each payment is calculated and added. E.g. if Rs 100 is paid at the end of each year for 10 years, we calculate PV of each of these 10 payments of Rs 100 separately and add these 10 values.

- Similarly, for calculating FV of Annuity, FV of each payment is calculated and added. E.g. if Rs 100 is paid at the end of each year for 10 years, we calculate fv of each of these 10 payments of Rs 100 separately and add these 10 values.

The present value an annuity is the sum of the periodic payments each discounted at the given rate of interest to reflect the time value of money.

PV of an Ordinary Annuity = R (1 − (1 + i)^-n)/i

PV of an Annuity Due = R (1 − (1 + i)^-n)/i × (1 + i)

Where,

i is the interest rate per compounding period;

n are the number of compounding periods; and

R is the fixed periodic payment.

In the formulae, given, we have to correctly arrive at r, i.e.the interest rate. E.g.the given intt rate is 12%p.a.If the payment is received yearly, r will be equal to 12/100=0.12.But if payment is received monthly, it will be 12/100*12=0.01.For quarterly payment, it will be 0.03 and for half yearly payment, it will be 0.06

Example :

1. Calculate the present value on Jan 1, 2015 of an annuity of 5,000 paid at the end of each month of the calendar year 2015. The annual interest rate is 12%.

Solution

We have,

Periodic Payment R = 5,000

Number of Periods n = 12

Interest Rate i = 12%/12 = 1%

Present Value

PV = 5000 × (1-(1+1%)^(-12))/1%

= 5000 × (1-1.01^-12)/1%

= 5000 × (1-0.88745)/1%

= 5000 × 0.11255/1%

= 5000 × 11.255

= 56,275.40

2. A certain amount was invested on Jan 1, 2015 such that it generated a periodic payment of 10,000 at the beginning of each month of the calendar year 2015. The interest rate on the investment was 13.2%. Calculate the original investment and the interest earned.

Solution

Periodic Payment R = 10,000

Number of Periods n = 12

Interest Rate i = 13.2%/12 = 1.1%

Original Investment = PV of annuity due on Jan 1, 2015

= 10,000 × (1-(1+1.1%)^(-12))/1.1% × (1+1.1%)

= 10,000 × (1-1.011^-12)/0.011 × 1.011

= 10,000 × (1-0.876973)/0.011 × 1.011

= 10,000 × 0.123027/0.011 × 1.011

= 10,000 × 11.184289 × 1.011

= 1,13,073.20

Interest Earned = 10,000 × 12 − 1,13,073.20

= 1,20,000 – 1,13,073.20

= 6926.80

……………………………………………………………………………………………………………………………………………

|